The NFT Gold Rush: How Cryptoartists Kick-Started a Boom - The New York Times

my notes ( ? )

NFTs, or nonfungible tokens, represent a unique relationship between owner, artist and art. They are "digital files created using blockchain computer code... essentially impossible to duplicate" and so can be owned & resold, like any work of art. Anyone can download a copy of the art, but the NFT is unique. Noone cares if the art is copied and disseminated: "Millions of people staring at a piece of digital art make it more valuable for the person who owns it"

Crpto-natives (The Future!) vs. sceptics (just "crypto zealotry ... to keep ... Ether and Bitcoin prices high"). Environmental costs: Ether's network consumes similar energy as Hungary, although "NFTs can be verified on Ethereum using ... “proof of stake,” which uses as little as 0.01%".

"Cryptocurrency networks like Ethereum are fairly transparent... transaction records... are publicly visible ... but anonymous... [so] criminal enterprises value cryptocurrencies".

Most winners from NFTs are "already winners in the modern attention economy... traditional celebrities and brands..."

NFTs pioneered by Kevin McCoy, who wondered if blockchain could provide "a new revenue stream for creators... enable an artist to sell works to fans directly... collaborating with the entrepreneur Anil Dash, created an experimental crypto token for a piece of his own digital art". Few understood.

Then Matt Hall and John Watkinson created 10000 collectible characters called CryptoPunks, used Ethereum to create 10000 NFTs, kepy 1000 and allowed others to be claimed for free. Mashable wrote a story: "within 24 hours they were gone... Owners began reselling ... for hundreds of dollars ... then tens and hundreds of thousands of dollars... By the end of 2017, some...were selling for as much as $170,000."

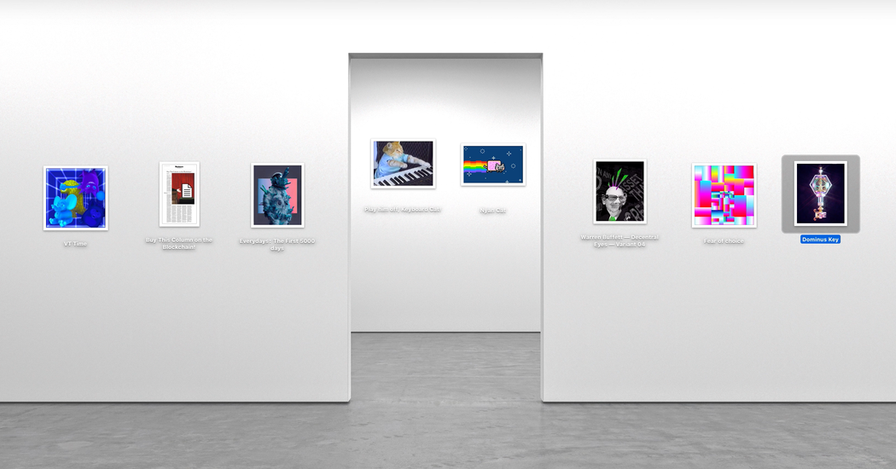

Inspired SuperRare: entire new market giving higher% sale price to cryptoartists PLUS "a cut of resales, something generally unheard-of". So a successful artist's descendants can inherit a perpetual revenue stream.

Prices soared. The underlying phenomenon is game theory: "a collectible abruptly becomes widely desirable merely because, in a self-reinforcing loop, other people think it’s desirable... like bitcoin itself". Unsurprisingly, early investors are bitcoin millionaires: "buying cryptoart gives them something artsy to talk about in a field dominated by otherwise numbingly technical conversations... the aesthetics — and its clubby, Twitter-heavy networking — felt like an art scene they could finally “get.”... an art form for an Internet-addled mind"

"a tiny minority of artists and collectors held most of the wealth produced by NFT art... almost entirely male"

Sundaresan and Venkateswaran created a “decentralized finance” product, aka “defi” play:

- bought 20 of beeple's "Everyday" pieces for $2.2m, then paid $69 million for a NFT of 13 years of "Everyday" pieces

- paid artists to build virtual 3D museum galleries to display the 20 pieces, open to all

- created 10 million B20 tokens, each representing a fractional ownership of the 20 pieces. 10% went to the museum artists, 2% to Beeple, kept 50%, put some up for sale. B2o peaked at $27m

Read the Full Post

The above notes were curated from the full post www.nytimes.com/2021/05/12/magazine/nft-art-crypto.html.Related reading

More Stuff I Like

More Stuff tagged nft , token , beeple , defi , art

See also: Blockchain, Crypto, NFTs etc